MFS Market Insights – 10/10/2017

We had a good conference call with the team from MFS to go over their outlook on the global economy and investments. Below are some of the talking points that were discussed:

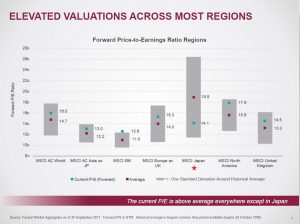

- We are in a synchronized global recovery considering much of the economic data. We however still need to look at valuations prior to moving deeper into riskier assets.

- Everything but Japan is really trading at very high multiples. Additionally all sectors appear to be at higher valuations.

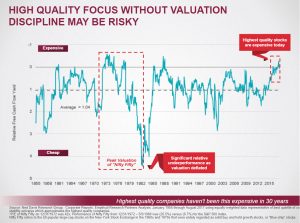

- Highest quality companies haven’t been this rich in 30 years.

- Despite valuations being relatively rich, markets have taken this into consideration and continued higher. This could mostly be driven by cheap money / low interest rates. When that ends is unknown…

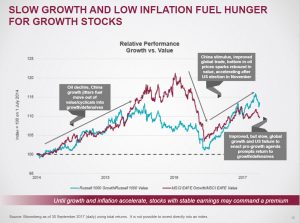

- Growth has been trading much better than value with a fairly substantial divergence

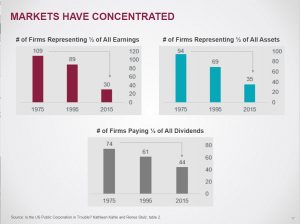

- The business playing field has narrowed considerably over the years. Rather than businesses servicing your region or state, companies are getting bigger if they perform well and they become providers globally, not just nationally or regionally. Markets are becoming ever more concentrated.

- In the 1990’s, the top 5 global stocks accounted for 2% of market. Now, they account for 5% of total market cap. So What? Theoretically concentration rising takes away competition. Less competition generally leads to less innovation and less growth in the labor markets as many smaller startup companies drive labor. Innovation will continue to be suppressed. This generally also leads to higher prices as there is less competition. Much of this may be due to the increasingly stringent regulatory environment that is has become difficult to navigate as well as globalization of markets.

- Hard to determine where the monopolies are in a digital age. Platforms are pursuing growth over profits. i.e. expanding rather than trying to make money. Think of the many companies that are going volume over price (Costco, Amazon, Walmart, etc…).

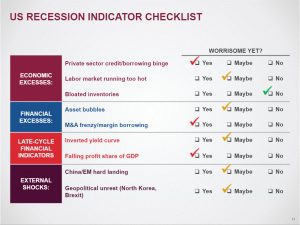

U.S. Recession Indicator Checklist:

- Thinks Labor market may be running a little hot.

- May be an asset bubble in credit but not particularly. Only bubble really is crypto-currencies.

- Seeing quite a bit of excess in M&A. Companies are looking to grow in-organically by merging or buying others.

- Private Sector borrowing – Back to debt to asset levels similar to 2007 albeit much cheaper.