Litman Gregory Masters Alternative Fund (MASNX)* – Semi-Annual Report Review

Litman Gregory Masters Alternative Fund (MASNX)* – Semi-Annual Report Review

(If you would like to read the full report, please see this LINK)

After reading through the semi-annual report, we thought we would put together a brief summary of some of the main bullet points that we believed to be relevant.

First though, for those that are unaware of this fund and its purpose, below is a brief summary:

“The Alternative Strategies Fund is a multi-manager fund that combines alternative and absolute-return-oriented strategies chosen based on Litman Gregory’s conviction that each individual strategy is compelling and that collectively the overall fund portfolio is well diversified. This fund is intended to complement traditional stock and bond portfolios by offering diversification, seeking to reduce volatility, and to potentially enhance returns relative to various measures of risk.

This fund will contain many risk-control factors including the selection of strategies that seek lower risk exposure than conventional stock or stock-bond strategies, the risk-sensitive nature of the managers, the skill of the managers, and the overall strategy diversification.

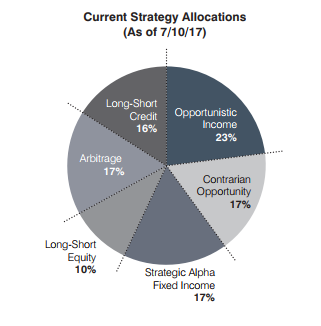

Typically, each manager will run between 10% to 25% of the portfolio, but Litman Gregory may tactically alter the managers’ allocations to attempt to take advantage of particularly compelling opportunities for a specific strategy or to further manage risk. We will have a high hurdle for making a tactical allocation shift and don’t expect such top-down shifts to happen frequently.”

Summary of Semi-Annual Report

Performance through 6/30/2017: Performance slightly lagged the performance of its peers in the first half of 2017. However, on a longer term 1-, 3- and 5-year basis, the fund has significantly outperformed its respective benchmarks. In addition, the funds volatility remains very low with a standard deviation of only 3.21% along with a beta of only 0.25 when compared to the overall stock market. This is exactly how we would like this type of fund to perform as it is meant to be a low volatility and low correlation to the overall market. As this is an alternative investment, we want slow steady returns that aren’t necessarily correlated with how the stock market performs.

- Masters Alternative Strategies Fund (MASNX) : +2.21%

- Morningstar Multi-Alternative Category: +2.27%

- HFRX Global Hedge Fund Index +2.54%

Portfolio Changes:

- A new sub-manager has been onboarded. DCI is a San Francisco based firm focusing on systematic, quantitatively driven portfolios of long/short and long only credit strategies. The company will be slotted to manage an absolute return long/short credit strategy for the fund.

- Passport Capital has been put on the watch list due to turnover at the firm and disappointing performance. At this time Masters believes that procedures have been put in place to potentially rectify some of the issues that they currently face, but they are “cautiously optimistic”. They will continue to monitor this firm for its inclusion within the fund.

Individual Sub-Manager Performance YTD through 6/30/2017:

As this is a multi-manager fund, it is important to measure the performance of both the entire fund as a whole and also how each individual manager has performed. Let’s take a closer look at these:

- FPA Contrarian Opportunity: +5.23%

- Performance was extremely good especially when considering the large cash position that is held on the books. (~33%)

- Starting to add small short hedges to the Russell 2000 as they are seeing stretched valuations.

- Seeing stretched valuations across the board which is deterring them from committing too much capital at once.

- DoubleLine’s Opportunistic Income: +3.95%

- Produced strong relative performance.

- Residential Mortgage Backed Securities were a major contributor to positive returns within the portfolio. This is one of the largest positions in the portfolio at 58%.

- Inverse Floating Rate and Inverse Interest Only obligations within the portfolio did not perform as well due to the front end of the yield curve rising.

- Water Island Arbitrage and Event Driven Strategy: +3.02%

- Steady performance continues.

- All three sub-strategies (Merger Arb., Special Situation Equities, and Credit Opportunities) contributed positively to returns.

- Water Island believes increased deal flow and rising rates should continue to provide a positive environment for their event driven type of investing. However, deal volatility currently remains low meaning that spreads are really only showing the potential for 4.00% – 6.00% returns.

- Loomis Sayles Absolute Return Fixed Income Strategy: +0.71%

- The small/modest gain was diversified across many sectors within the strategy.

- High Yield

- Securitized assets such as ABS and RMBS.

- Investment Grade Corporates

- Emerging Market Bonds

- Most of the positive contributions came from the energy, communications and technology sectors within credit.

- Detractors include:

- Energy sector equity exposure. However, Loomis is still very comfortable with these positions as they tend to believe oil prices will continue to inch higher over the next year.

- Risk management tools within equity index futures / options as well as interest rate futures detracted. These positions are being used to manage and hedge market risks that they are witnessing.

- Hold short positions in longer dated treasury futures.

- Hold short positions in S&P 500 futures.

- The small/modest gain was diversified across many sectors within the strategy.

- Passport Long-Short Equity Strategy: -0.63%

- The strategy rebounded from the disappointing first quarter results to bring the first half performance to down only 0.63%.

- Focused heavily on Saudi Arabian equities as they believe there is the prospect of major growth in the region. Additionally, Passport had a very strong conviction that Saudi equities would be added to the MSCI Emerging Markets Index watchlist which was validated in June of this year.

- Ongoing plan is to focus on fewer sectors taking longer-term concentrated positions in their highest conviction ideas.

- At the end of the second quarter the strategy was positioned about 100% long and 45% short for a net long positioning of 55%.

- Attractors included:

- Positions in Saudi Arabian equities adding 1.40% to the portfolio.

- Technology stocks (+1.10%)

- Emerging market equities (+0.80%) – Primarily Chinese internet companies Alibaba and Altaba.

- Detractors included:

- Equity positions in the energy sector (-1.40%)

- Market hedges (-1.00%)

* – At the time the investment in MASNX applies to Stage 2 portfolios only.