On 12/12/2017, we attended a webinar from PIMCO on why bonds are different in the active vs. passive management argument. At eNVESTOLOGY we believe that both active and passive management belongs within an investors portfolio. However, there are sectors and asset classes where active management makes more sense and can provide a better fit than a passive ETF. This is especially true with regard to certain fixed income strategies and PIMCO agrees. Here’s the reasons why:

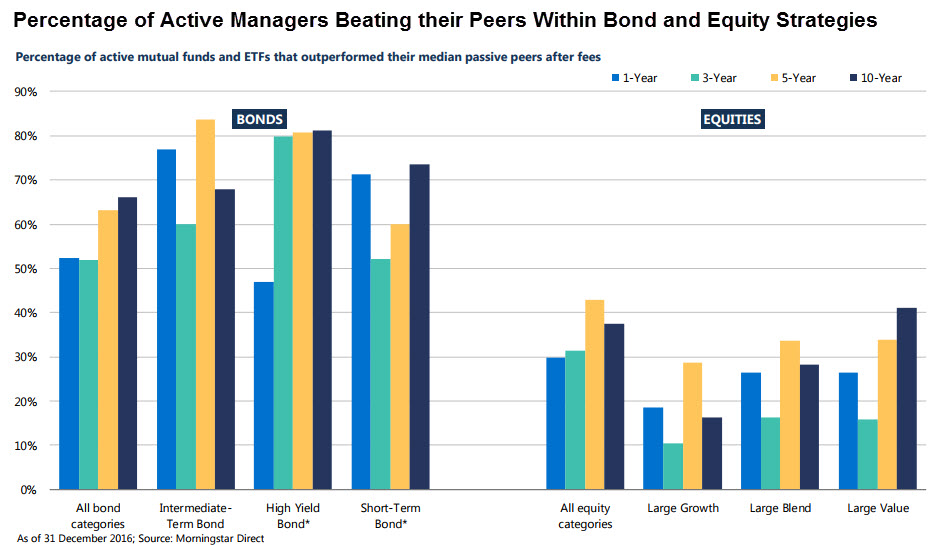

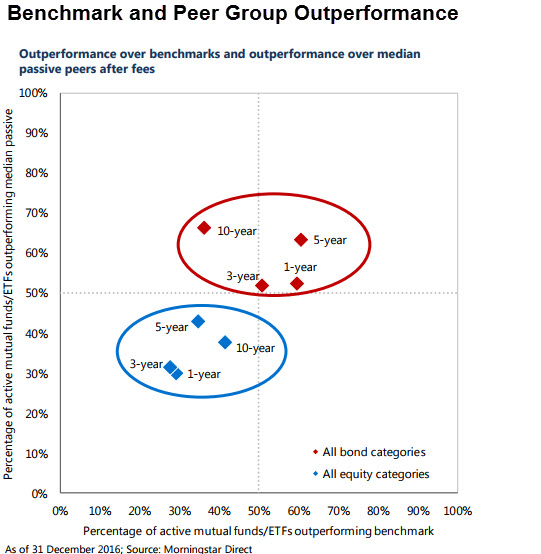

As a general rule, actively managed bond funds have outperformed passively managed ETFs even after fees. In general more than 60% to 80%+ of actively managed funds outperformed their passively managed counterparts across multiple time frames (1Yr, 3Yr, 5Yr, 10Yr).

Indexing or replicating a benchmark index is an extremely difficult task within the fixed income space. Benchmark index performance many times is not real-world practically achievable due to the various qualities and constraints that bonds carry. Transaction costs are much higher in bonds than they are in stocks. Bid-Ask spreads can be extremely wide even in a normalized market when buying or selling bonds. In bonds, just on a day to day basis, this spread could be 3%-5% and during a crisis or time of liquidity constraint, there could be 10%-20% spread. Additionally, withholding taxes for purchasing foreign bonds are not accounted for when looking at an index or benchmark performance. Knowing the ins and outs of buying and selling bonds vs. blindly following an index creates an efficiency for active managers allowing them to potentially add alpha over time.

Bonds Mature, Equities are Perpetual. Bonds are different then stocks because of the number of securities moving in and out of the index. Bonds mature and then new ones are re-issued. The index is dynamically changing all the time where as an equity index is pretty consistent. Over a one year period, about 20% of all bonds are new issues, whereas within equities only about 0.78% are new issues. Passive strategies don’t have a lot of ability to get into new issuances as they aren’t part of the index yet. Generally new issuances trade at a discount even for the same issuer or maturity due to concessions that have to be made to raise funds. Active can buy the new issues when they are issued at a discount whereas passive strategies usually have to wait until the end of the month to purchase when the new issue is put into the index.

Managing liquidity can be extremely problematic for passive bond investing. During times of liquidity constrains, bond indexing becomes extremely difficult. Many times, the index can no longer be replicated as the ability to buy and sell securities within the index become unavailable to trade. If a security within an index is not available to be purchased or there are no buyers for a fixed income product then the benchmark can not be exactly replicated. Active managers many times will plan ahead for liquidity concerns by building cash ahead of time and managing durations.

Unlike stocks, bond markets have non-economic investors (investors whose main objectives may not be to achieve added returns) that play a large role within the space. These include entities like Central Banks, Commercial Banks, Insurance Companies and others. These types of players are constrained by factors which require them the need to own certain securities in order to achieve a goal other then investment gain. Rather than utilize bonds as an investment, they are utilizing them to stabilize exchange rates, regulate interest rates, manage the money supply in a market, hedging out various risks (annuities, life insurance payouts, capital requirements, etc…) or sometimes they are even required to own certain fixed income securities due to regulations. 47% of all bonds in the global marketplace are held by these non-economic investors. Many times, this creates opportunities for actively managed strategies to leverage this knowledge and gain an edge within the marketplace thus generating alpha.

The main conclusion here is that bonds are totally different from equities in the active vs. passive management argument. While arbitrage and pricing inefficiencies are quickly closed in an equity market, this is not entirely the case within the bond market. The end result is that many active managers are beating their passively managed ETF peers within this space.